41 step up coupon bonds

Stepped coupon bond financial definition of stepped coupon ... A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. What are Step-up Bonds? Example, Types, Advantages, and ... Step-up bonds are the type of bonds that come with a variable increasing coupon rate. These are better than fixed-income bonds, and allow lenders to get a higher interest on the bond. There are two main types of step-up bonds, single step-up and multiple step-up bonds. See also What is a Bank Account Title? (Explained)

What is a Step-Up Bond? - Accounting Hub A step-up bond comes with a lower interest rate initially. Its interest rate steps up after a specific period as described by the issuer. The interest rate of this bond can increase over specified intervals and up to a specified extent. It can be a single increase in the interest rate and several hikes depending on the terms of the bond.

Step up coupon bonds

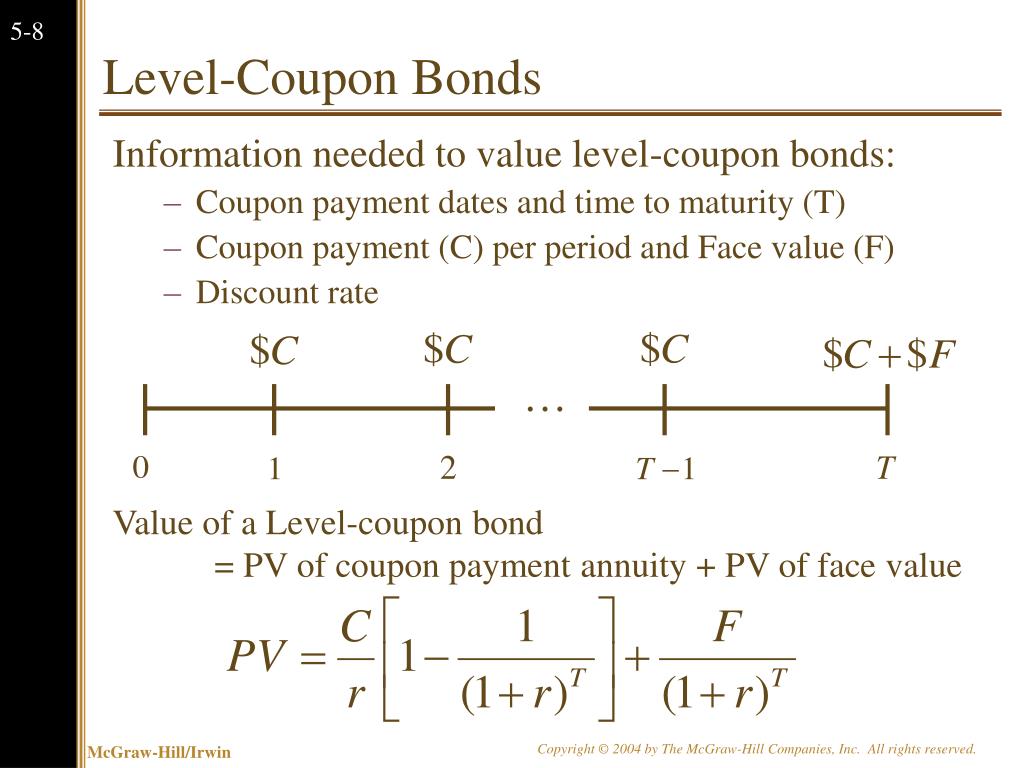

› types-of-income › step-upsStep-Ups - Types of Fixed Income Bonds | Raymond James At the most basic level, step-up bonds have coupon payments that increase (“step-up”) over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period. Step-up bonds may reset once or reset multiple times (multi-step bonds) during the life of the bond. Coco Bonds Complete Guide - Track Live Bond Prices Online ... Coupon Step-ups. Some CoCos may also have a coupon step-up besides the reset. A step-up implies an additional coupon increase in the event that the bond is not called on its call date. This might give some cushion to the investor in case the bond is not called. In other words, this coupon step-ups might act as an incentive to call back the bonds. How to calculate the yield to maturity for a step-up ... 1 - Knowing the maturity, coupon rate, and yield are sufficient to calculate the bond price. 2 - First, you have to find the PV of all remaining coupons using this rather complicated-looking formula: PV==P* ( ( (1 + R)^N - 1)* ( (1 + R)^-N)* R^-1), where P==coupon rate, R=="asked" yield, N==Number of coupon periods.

Step up coupon bonds. PDF Understanding Callable Step-up Investment Products Multi Step-Up A multi step-up bond may adjust many times during the life of the investment, if it is not called. For example, a 15-year multi step-up certificate of deposit may begin with a coupon rate of 5.00 percent in year one and adjust in increments to reach 13.00 percent in year 15. Typically, the coupon paid on a callable step-up bond is Accounting for Step-Up Bond | Example | Advantage ... Multi Step-up bond is the step-up bond in which the coupon rate increases more than one before the maturity date. Advantage of Step Up Bond. High return for investors: Investors will receive more return by investing in step-up bonds, the interest rate will keep increasing over time. If compared to normal bonds, the step-up bonds will generate ... What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to... Step-Up & Step-Down Bond Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond.

cleartax.in › g › termsStep-Up Bond - Definition, Understanding, and Why Step-Up ... Mar 11, 2022 · A step-up bond is a security that has a coupon rate which increases with time. A step-up bond typically performs better than any other fixed-rate investment in a rising rate market. The Securities and Exchange Commission (SEC) regulates the step-up bonds. Step-up bonds tend to have lower coupon rates or interest rates initially since they have the step-up feature. › terms › sStep-Up Bond Definition - investopedia.com Oct 21, 2020 · Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases in the coupon... Are step-up bonds good protection against rising rates? These are just the opposite of Step-Up Bonds. These are bonds where the coupon usually steps down after a certain period. They may also be designed to step down not once but in a series too. Floating rate bonds are so called because they have a coupon which is not fixed but rather linked to a benchmark. These types of bonds are similar to the ... Step-Up Coupon Bond | Derivative Valuation, Risk ... A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases.

Types of bonds based on cash flows - Fixed Income ... A step-up coupon bond is a bond, either fixed or variable, whose spread increases incrementally over the life of the bond. Bonds with step-up coupons offer protection against rising market interest rates. It is because when market interest rates increase, the bond's coupon rates also increase thereby limiting any decrease in bond value. Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S 653 Step Up Bonds | Meaning, Single, Multiple, Callable Bonds ... Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year. Sustainability-linked bonds: The investor perspective | Nordea The bonds' financial characteristics also vary among issuers, even if the coupon step-up structure, introduced by ENEL in 2019, seems to be accepted as the market standard. For a more nuanced picture of the market, we decided to conduct an investor survey, to better understand investors' approach to the format and their view on its ...

What Is a Step-up Bond? But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work

Step-Up Coupon Securities financial definition of Step-Up ... A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change.

All the 21 Types of Bonds | General Features and Valuation ... Step-Up Bonds. The step-up bonds are where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series. Such bonds are usually issued by companies where revenues/ profits are expected to grow in a phased manner. These are also called dual coupon or multiple coupon bonds. Step Down Bonds

Step-Up Bonds Definition & Example - InvestingAnswers A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ.

Raymond James Financial | Services and Products | Bond Basics | Types of Income | Step-Up Bonds

Step Up Bonds: Pros and Cons Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period.

NextEra Energy introduces coupon step-up on green bond | IFR US company NextEra Energy Capital Holdings (Baa1/BBB+/A-) included a "green non-certification event" on its recent seven-year US$1.5bn green bond that introduces a coupon step-up if the company fails to produce an allocation and impact report within a specified time to address investors' concerns about transparency.

harbourfronts.com › step-up-coupon-bondStep-Up Coupon Bond – Harbourfront Technologies Feb 05, 2021 · A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases.

Need a way to calculate YTM for a bond with a step-up ... It's no different to calculating any other yield. Using Excel, just multiply the notional by the coupon for each period, get the =yearfrac() for each period, get the PV via compound interest, ie multiplying flow * 1/(1+r/f)^(t*f) where r is your yield. sum up all the PVs, subtract the accrued interest and try and match the bond price.

Do EE and E bonds obtain a step-up basis when inherited ... 3 attorney answers. These bonds do not get a step-up in basis. The recipient must pay an income tax on all interest earned on them from inception to the redemption. (As one of the attorney's mentioned, they are income in respect of decedent and there is no step up in basis for these items.)

Deferred Coupon Bonds: Definition, How It Works, Types and ... Step-Up Bonds These bonds do not make coupon payments until a certain period. For instance, a bond can start interest payments after 5 years with a 10 year maturity period. Toggle Notes Toggle notes pay increased interest rates after a certain period. Investors expect higher interest rates with a deferred payment condition.

How to calculate the yield to maturity for a step-up ... 1 - Knowing the maturity, coupon rate, and yield are sufficient to calculate the bond price. 2 - First, you have to find the PV of all remaining coupons using this rather complicated-looking formula: PV==P* ( ( (1 + R)^N - 1)* ( (1 + R)^-N)* R^-1), where P==coupon rate, R=="asked" yield, N==Number of coupon periods.

Coco Bonds Complete Guide - Track Live Bond Prices Online ... Coupon Step-ups. Some CoCos may also have a coupon step-up besides the reset. A step-up implies an additional coupon increase in the event that the bond is not called on its call date. This might give some cushion to the investor in case the bond is not called. In other words, this coupon step-ups might act as an incentive to call back the bonds.

› types-of-income › step-upsStep-Ups - Types of Fixed Income Bonds | Raymond James At the most basic level, step-up bonds have coupon payments that increase (“step-up”) over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period. Step-up bonds may reset once or reset multiple times (multi-step bonds) during the life of the bond.

Post a Comment for "41 step up coupon bonds"