41 suppose you bought a bond with an annual coupon of 7 percent

fin 300 Flashcards - Quizlet Bond prices. The Timeberlake-Jackson Wardrobe Co. has 7 percent coupon bond on the market with nine years left to maturity. The bonds make annual payments. If the bond currently sells for $1,038.50, what is its YTM? Bond Yields. Merton Enterprises has bonds on the market making annual payments, with 12 years to maturity, and selling for $963. Answered: 4. Calculating Returns [LO1] Suppose… | bartleby 4. Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year?

Finance Unit 8 Flashcards - Quizlet The bond in this question has a coupon rate of 10%. This means that the bond promises to pay 10% interest per year. As bonds are set a face values of $1,000, the annual coupon paid would be 10% x $1,000 = $100. When a bond is first issued, it is generally issued at par, which means. RR/YTM = Coupon rate.

Suppose you bought a bond with an annual coupon of 7 percent

Bond Price Calculator Let’s assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let’s figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 [Solved] Suppose you bought a bond with an annual coupon ... Suppose you bought a bond with an annual couponof 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c. Solved Suppose you bought a bond with an annual coupon ... Suppose you bought a bond with an annual coupon rate of 7.1 percent one year ago for $894. The bond sells for $920 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Total dollar return

Suppose you bought a bond with an annual coupon of 7 percent. Calculating Returns Suppose you bought a bond with an ... 3. Calculating Returns Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? Suppose that today you buy a bond with an annual coupon of ... The effective annual return of the stock account is expected to be 12 percent, and the bond account will earn 7 percent. When you retire, you will combine your money into an account with an effective return of 8 percent. The inflation rate over this period is expected to be 4 percent. Assignment 2.4.xlsx - Chapter 12 - Dropbox 2.4 Problem 1 ... Chapter 12 - Dropbox 2.4 Problem 1: Calculating Returns Create your Original Solution Below - Be sure to show all calculations and clearl Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today and has a standard $1000 face value. The inflation rate last year was 3 percent. Solved Calculating Returns [LO1] Suppose you bought a bond ... Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value, what was you total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c. If the

FIN/370 - Suppose you bought a bond with an annual coupon ... (5/4)- Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970.The bond sells for $940 today. Fin 311 Homework Questions 1 - 1. Suppose you buy a 7 ... Suppose you buy a 7 percent coupon, 20-year bond today when it's first issued. If interest rates suddenly rise to 15 percent, the value of your bond (increase, decrease, stay the same) 2. Ackerman Co. has 9 percent coupon bonds on the market with nine years left to maturity. The bonds make annual payments. If the bond currently sells for $934 ... Suppose you bought a bond with an annual coupon of 7 percent Share With Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. rated 5 stars Purchased 7 times Completion Status 100% View Answer Sitejabber (5.0) Merchant Circle (4.8) Trustpilot (4.6) Study Help Me (4.9) Chapter 10 Finance Flashcards - Quizlet To calculate the dollar return, we multiply the number of shares owned by the change in price per share and the dividend per share received. The total dollar return is: Dollar return = 270 ($82.84 - 76.33 + 1.45) Dollar return = $2,149.20 Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901.

Chapter 7 You'll Remember | Quizlet Suppose that today you buy a bond with an annual coupon of 7 percent for $1,090. The bond has 14 years to maturity. A) What rate of return do you expect to earn on your investment? Assume a par value of $1,000. B) What is the HPY on your investment? (your realized return is known as the holding period yield) (Solved) - Interpreting Bond Yields. Suppose you buy a 7 ... Coupon Rates. Osborne Corporation has bonds on the market with 10.5 years to maturity, an YTM of 9.4 percent, and a current price of $945. The bonds make semiannual payments. 1. Interpreting Bond Yields. Suppose you buy a 7 percent coupon, 20-year bond today when it's first issued. If interest rates suddenly rise to 15 percent, what happens ... You bought one of Elkins Manufacturing Co.'s 7.8 percent ... You bought one of Elkins Manufacturing Co.'s 7.8 percent coupon bonds one year ago for $1,061. These bonds make annual payments, mature 12 years from now, and have a par value of $1,000. Suppose you decide to sell your bonds today, when the required return on the bonds is 4.5 percent. Solved Suppose you bought a bond with an annual coupon ... Suppose you bought a bond with an annual coupon rate of 7.6 percent one year ago for $899. The bond sells for $930 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

Answered: 4. Calculating Returns [LO1] Suppose… | bartleby Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c.

Jenna bought a bond that was issued by Sherlock Watson Industries (SWI) three years ago. The ...

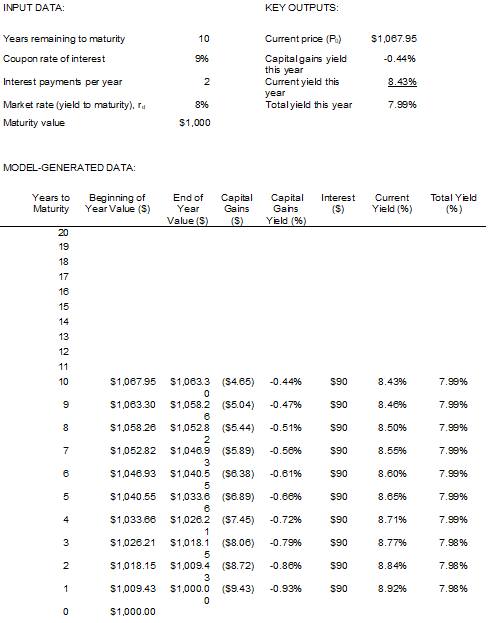

Chapter 7, Interest Rates and Bond Valuation Video ... a. Suppose that today you buy a 9 percent coupon bond making annual payments for $\$ 1,150 .$ The bond has 10 years to maturity. What rate of return do you expect to earn on your investment? b. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond sell for?

Post a Comment for "41 suppose you bought a bond with an annual coupon of 7 percent"