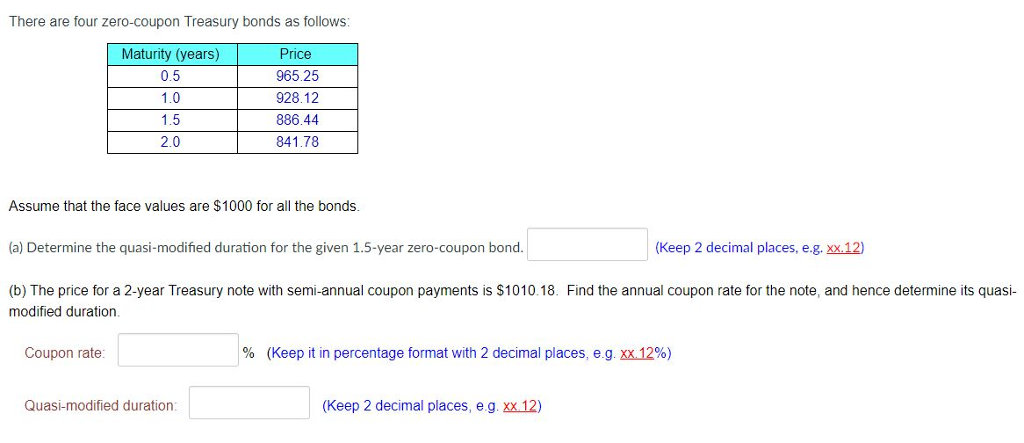

43 duration zero coupon bond

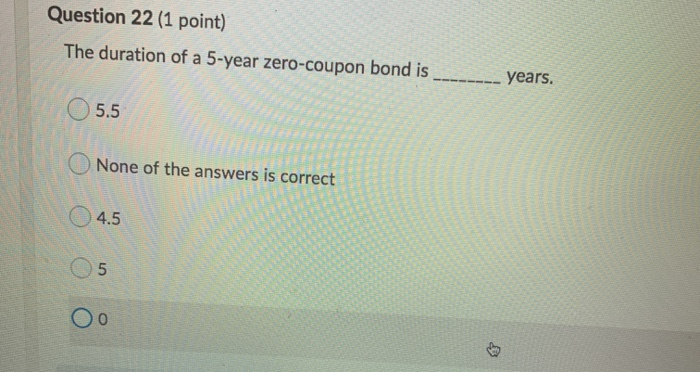

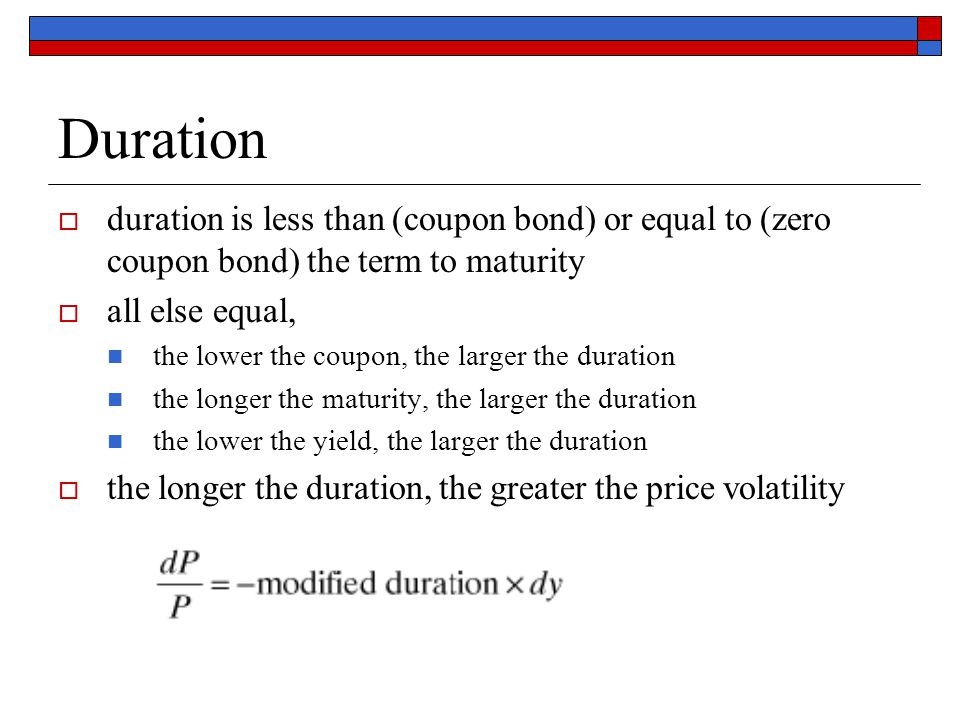

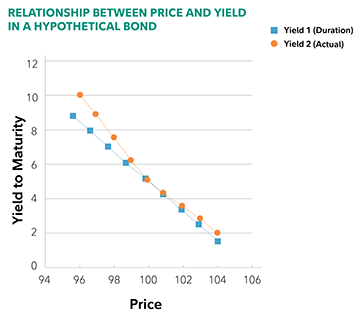

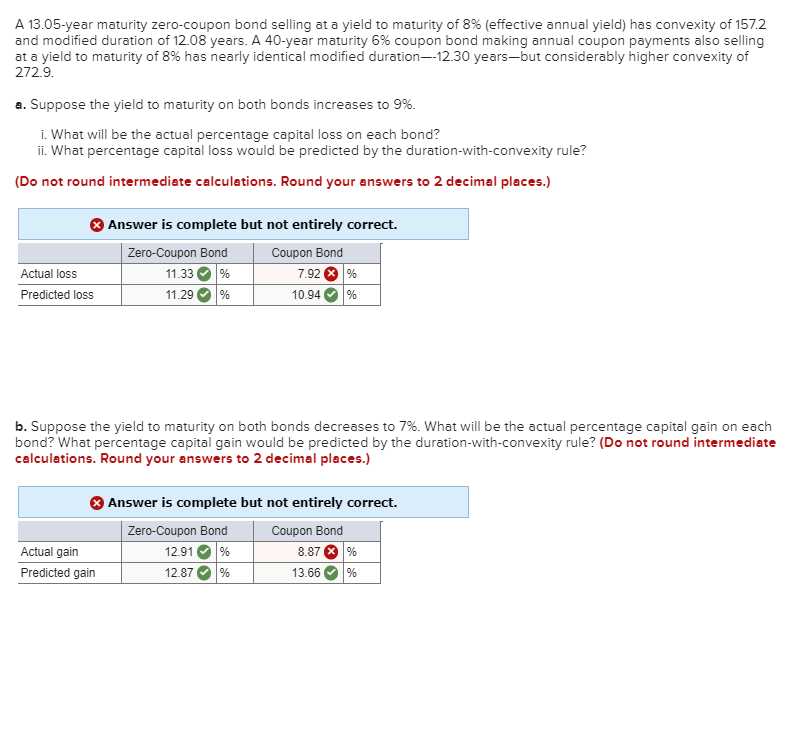

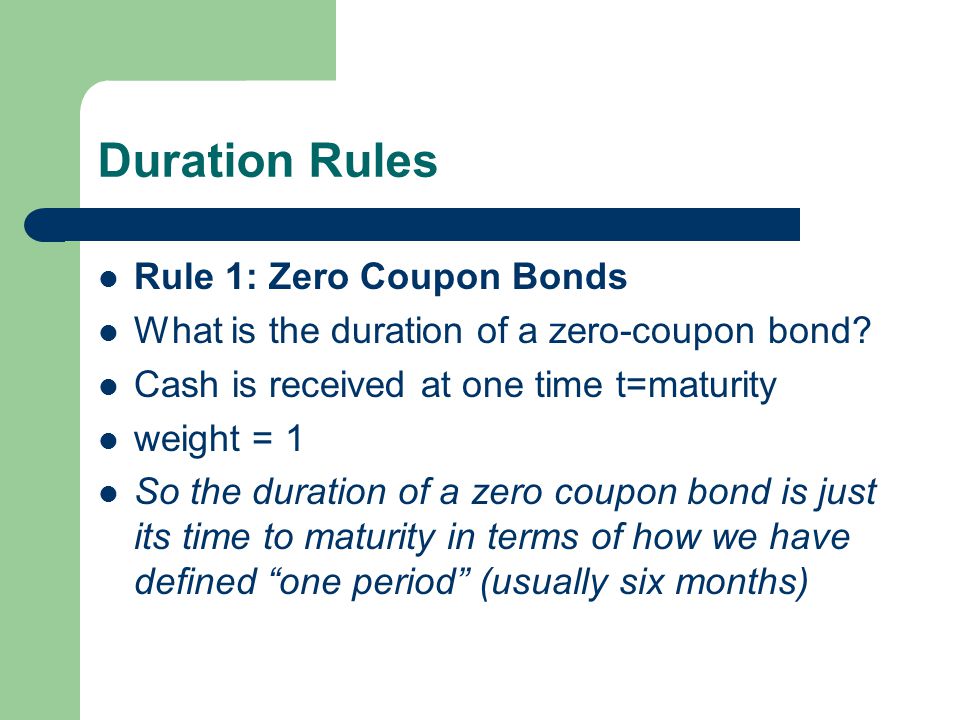

What is the duration of a zero coupon bond? - Quora The duration of a zero coupon bond is equal to its maturity. Duration is a weighted average of the maturities of all the income streams of a bond or a portfolio of bonds. Therefore if there are coupons, the duration will be less than the maturity, and if there are no coupons it will be equal to its maturity. Pete Zeman PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

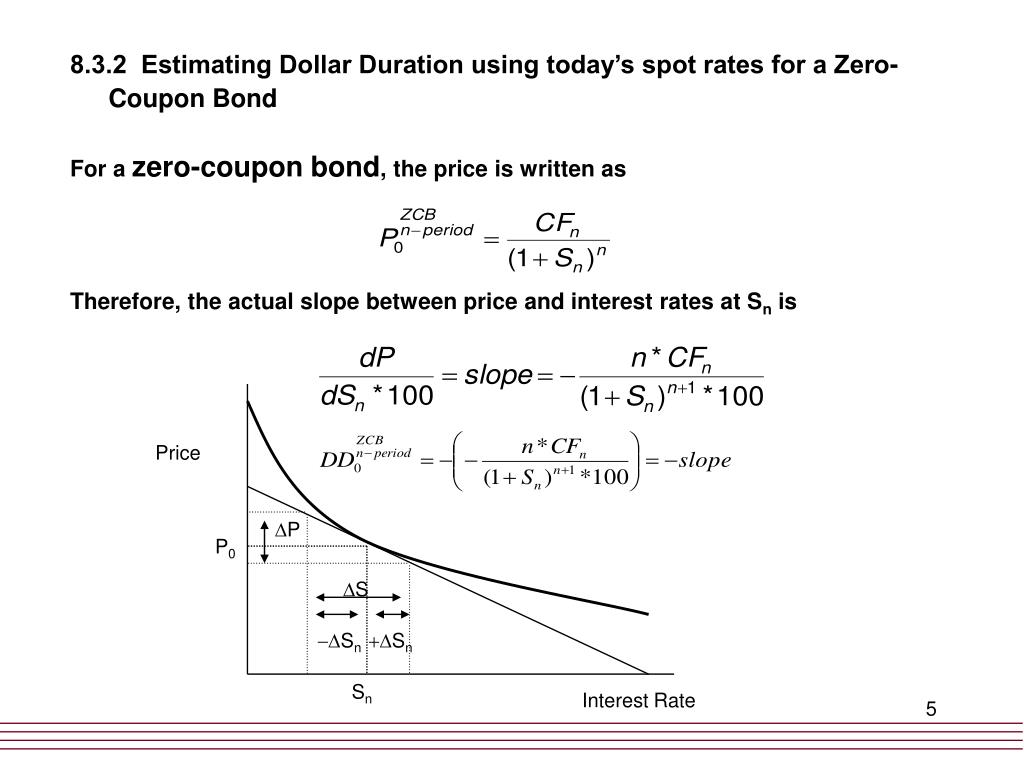

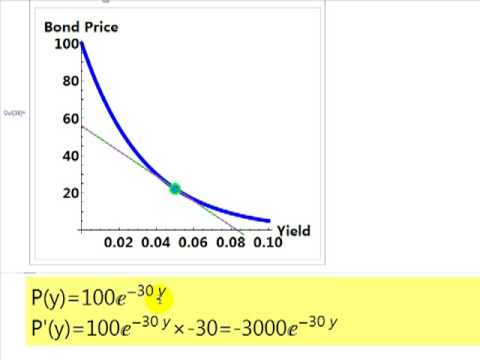

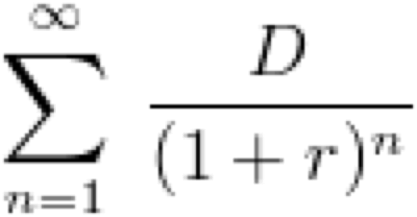

risk management - Calculate duration of zero coupon bond - Quantitative ... Let Pz (t, T ) be the price of a zero coupon bond at time t with maturity T and continuously compounded interest rate r. Duration = − 1 P d P d r Let A and a be two constants and x be a variable. Let F ( x) = A × e a x be a function of x. Then, the first derivative of F with respect to x, denoted by d F d x, is given by

Duration zero coupon bond

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. Generally, bonds with long maturities and low coupons have ...

Duration zero coupon bond. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Bond Duration | Formula | Excel | Example - XPLAIND.com Example. On 14 November 2017, you added the three bonds to your company's investment portfolios: (a) a $1,000 zero-coupon bond yielding 5.1% to maturity which is 31 December 2020, (b) a $100 face-value 6% semi-annual bond maturing on 30 June 2023 and yielding 4.8% and (c) a $1,000 face value 5.5% semi-annual bond maturing on 30 June 2023 and ... duration of zero coupon bonds | Forum | Bionic Turtle With respect to a zero coupon bond, Macaulay duration = maturity, and therefore must be a monotonically increasing function of maturity. On the other hand, DV01 of a zero (or deeply discounted) is not strictly increasing as DV01 = P*D/10,000 and the numerator has offsetting effects. If you'd kindly reference, I can fix? Thanks! Apr 7, 2012 #3 S

How to Calculate Bond Duration - wikiHow 3. Clarify coupon payment details. To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder). Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, ... A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms ... Dollar Duration - Overview, Bond Risks, and Formulas Dollar duration can be applied to any fixed income products, including forwarding contracts, zero-coupon bonds, etc. Therefore, it can also be used to calculate the risk associated with such products. Summary Dollar duration is the measure of the change in the price of a bond for every 100 bps (basis points) of change in interest rates. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

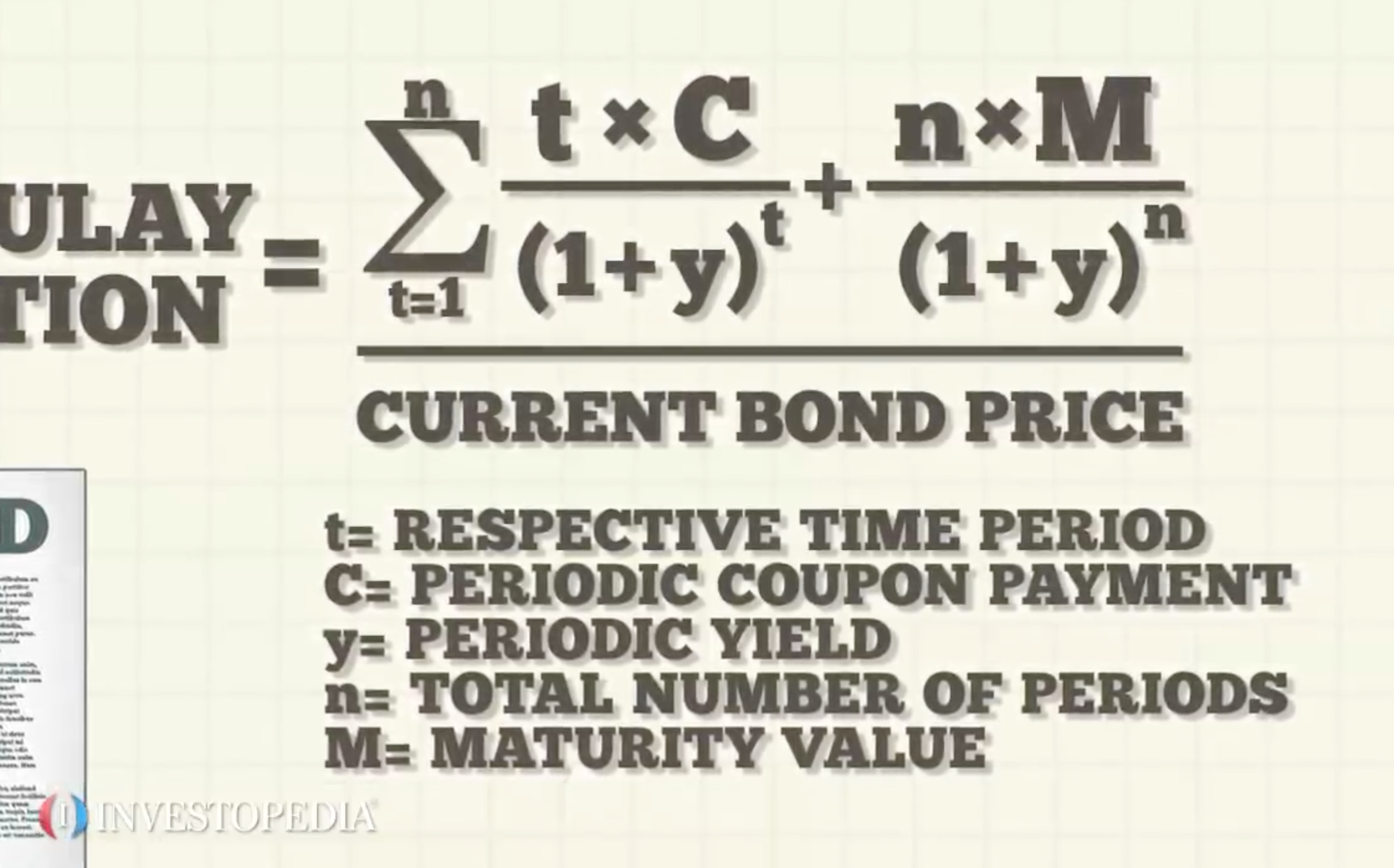

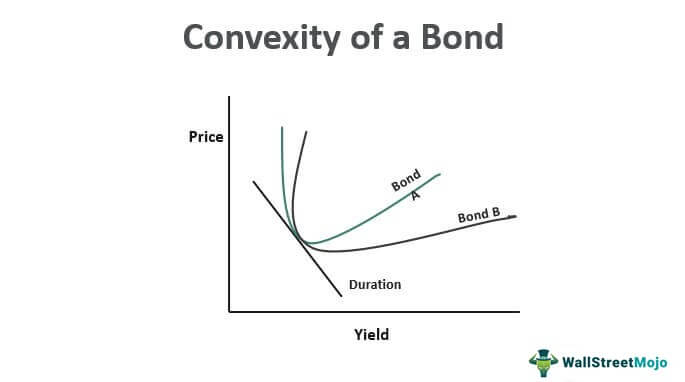

2022 CFA Level I Exam: CFA Study Preparation Bond duration is affected by many variables. The fraction of the period that has gone by (t/T). A plot of Macaulay duration (or modified duration) against time for a single bond with constant yield will show a saw-tooth pattern, with Macaulay duration declining steadily until a coupon payment results in an upwards jump.. The Macaulay duration of a zero-coupon bond is its time-to-maturity. What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N... Solved a. What is the duration of a zero-coupon bond that - Chegg Duration of the bond _____years c. What is the duration if the maturity increases to 17 years? Duration of the bond _____years; Question: a. What is the duration of a zero-coupon bond that has thirteen years to maturity? Duration of the bond _____years b. What is the duration if the maturity increases to 15 years? Duration of the bond _____years c. Solved 37. What is the duration of a zero-coupon bond that | Chegg.com 100% (1 rating) Zero coupon bond are not eligible for duration calculation as …. View the full answer. Transcribed image text: 37. What is the duration of a zero-coupon bond that has 7 years to maturity? What is the duration if the maturity increases to 10 years? If it increases to 12 years?

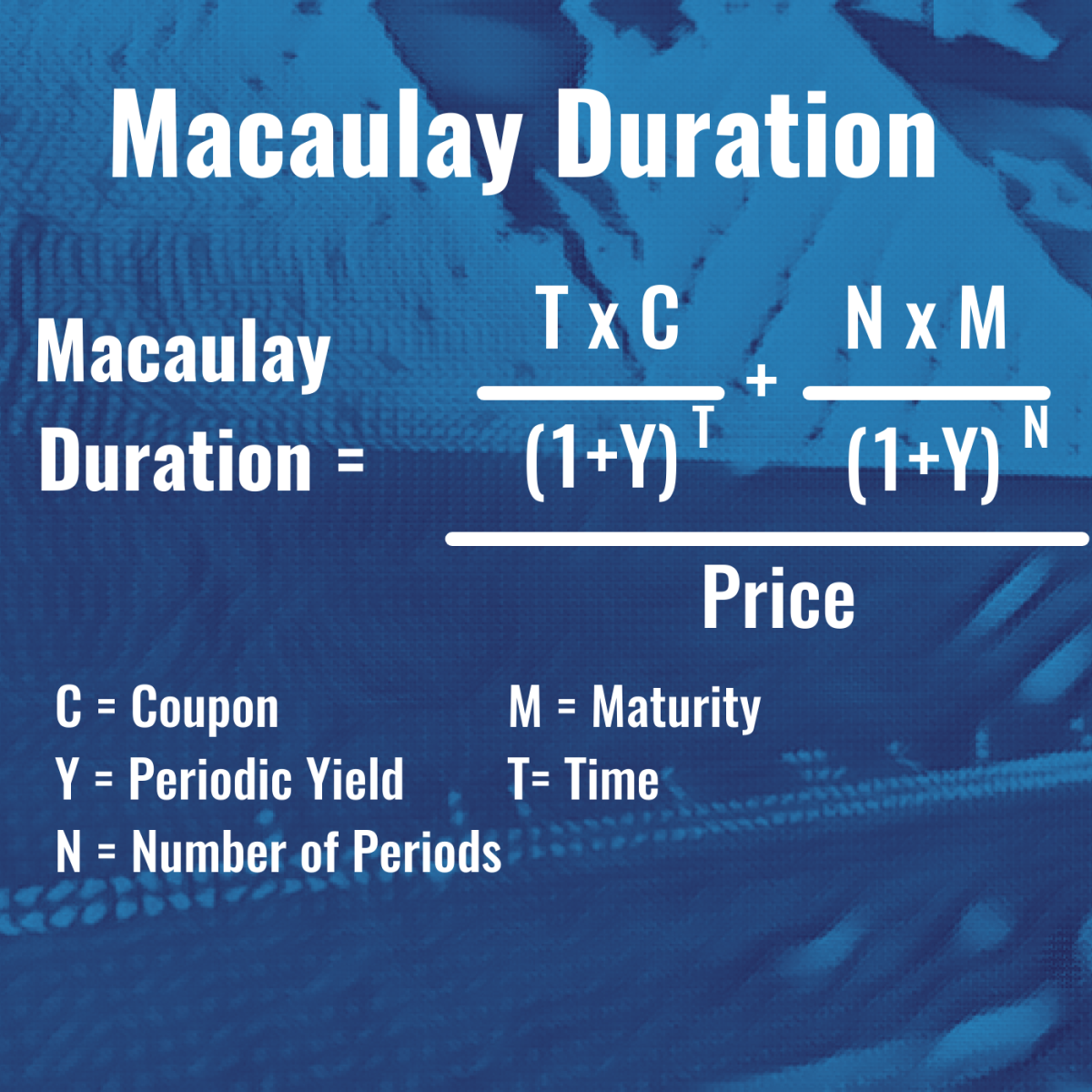

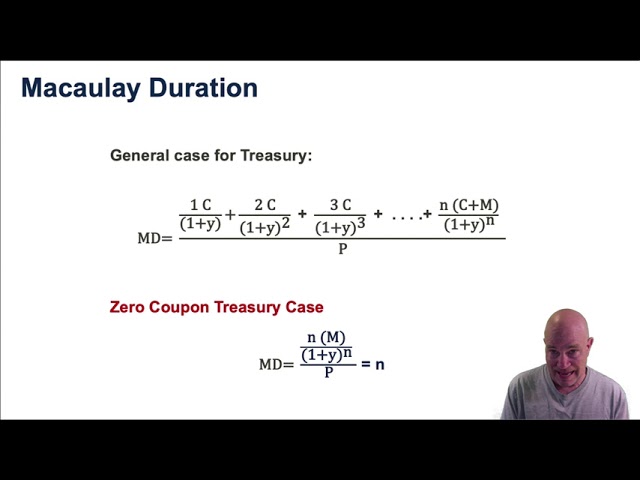

Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

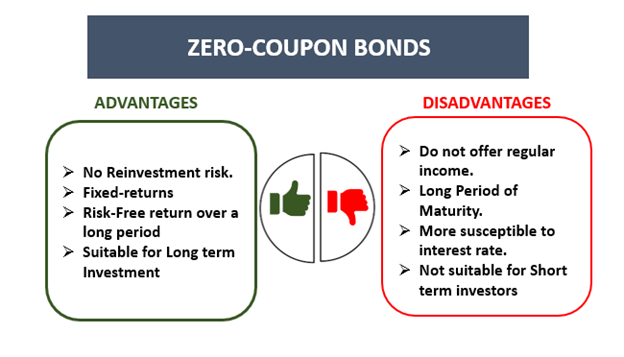

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index...

fixed income - Duration of callable zero coupon bond - Quantitative ... Assume a flat yield curve of 10%. What is the bond duration? A- 10 Years B- 5 Years C- 7.5 Years D- Cannot be determined based on the data given. According to me it should be 10 years as the duration of a zero coupon bond is always equal to its maturity. But I am not getting convinced with my answer because of the callable feature in the question.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond . Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!)

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used:

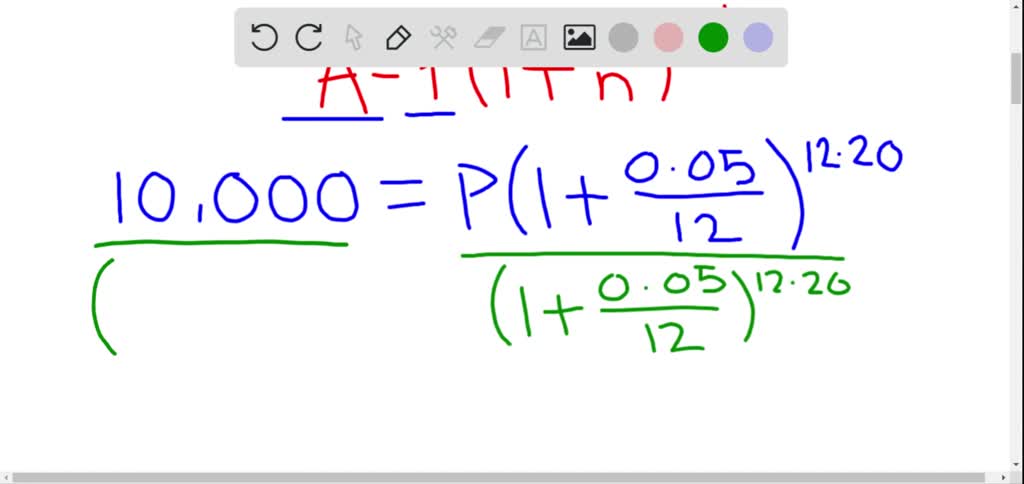

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

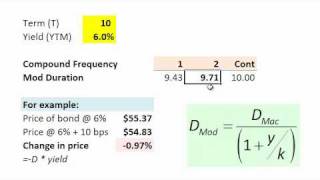

Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%.

Duration: Understanding the Relationship Between Bond Prices and ... In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. When a coupon is added to the bond, however, the bond's duration number will always be less than the maturity date. The larger the coupon, the shorter the duration number becomes. Generally, bonds with long maturities and low coupons have ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-02-a79edb63b9264dc9a76ee587240a27ea.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/KeyRateDuration-5c6bb05bc9e77c00014764e8.jpg)

Post a Comment for "43 duration zero coupon bond"