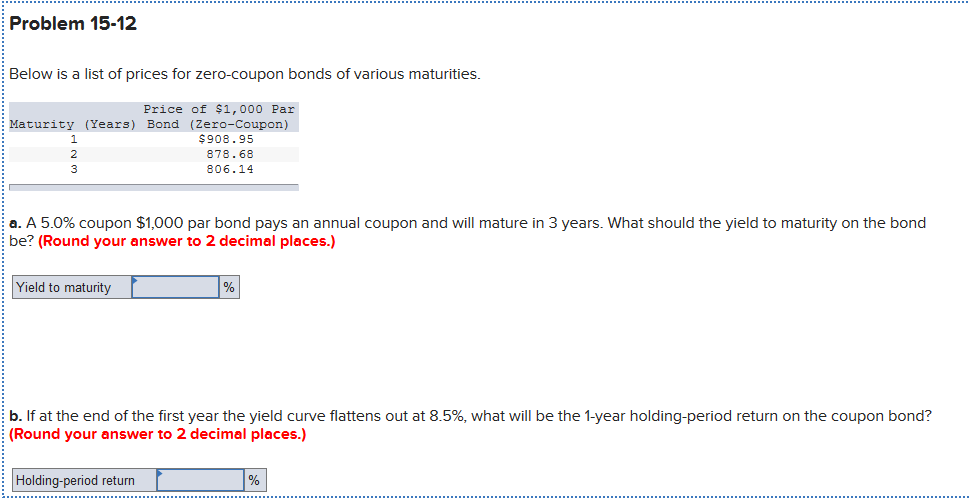

45 yield to maturity for zero coupon bond

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

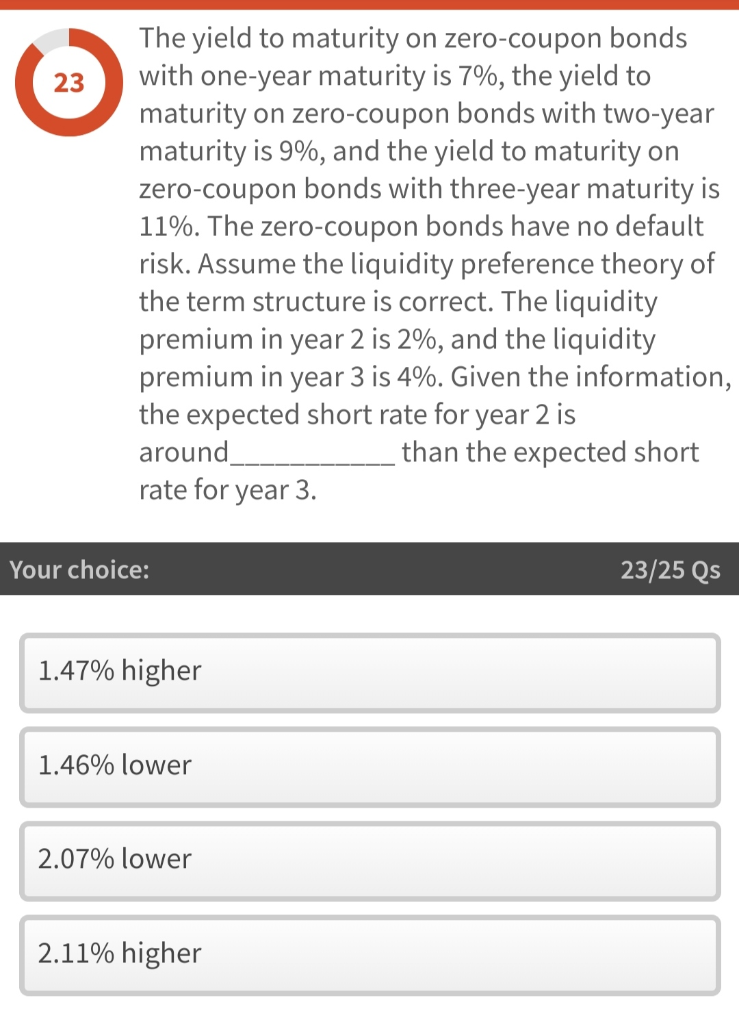

Solved The yield to maturity of one-year zero coupon bond is | Chegg.com The yield to maturity of one-year zero coupon bond is 8% and that of two-year zero coupon bond is 6.5%. Suppose the one-year forward rate is 6%, specify the arbitrage trading strategy. Question: The yield to maturity of one-year zero coupon bond is 8% and that of two-year zero coupon bond is 6.5%. Suppose the one-year forward rate is 6% ...

Yield to maturity for zero coupon bond

Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term. Solved A. What is the yield-to-maturity for a zero-coupon | Chegg.com What is the yield-to-maturity for a zero-coupon bond with a par value of $10,000 selling at $3,500 with 10 years to mature? Annual compounding is assumed for simplicity. I B. The market price is $282,500 for a 7% non-callable corporate bond with a par value of $250,000 and 14 years of maturity. It pays interest semiannually.

Yield to maturity for zero coupon bond. Zero-Coupon Bond: Definition, How It Works, and How To Calculate The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until... Solved You find a zero coupon bond with a par value of | Chegg.com This problem has been solved! You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). A ...

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

What is the yield to maturity (YTM) of a zero coupon bond with a face ... Answer (1 of 2): YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 ->... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. The yield to maturity on one-year-maturity zero coupon bonds is 5% ... The yield to maturity on one-year-maturity zero coupon bonds is 5% and the yield to maturity on two-year-maturity zero coupon bonds is 6%. The yield to maturity on two-year-maturity coupon bonds with coupon charges of 12% (paid yearly) is 5.eight%. What arbitrage alternative is offered for an funding banking agency? Solved 15, A zero-coupon bond has a yield to maturity of 9% - Chegg Question: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

Solved The yield to maturity on one-year zero-coupon bonds | Chegg.com The yield to maturity on one-year zero-coupon bonds is 8%. The yield to maturity on two-year zero-coupon bond is 8.9%. What is the forward rate of interest for the second year? Enter your answer as a decimal, rounded to four decimal places. Expert Answer Previous question

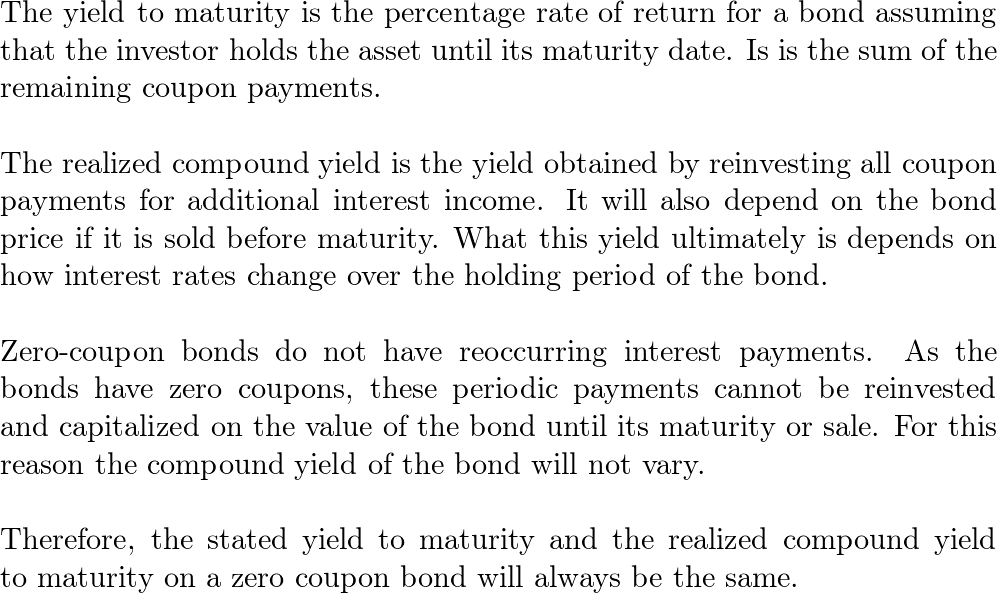

How do you calculate return on a zero coupon bond? The yield to maturity for zero-coupon bonds is also known as the spot rate. Subsequently, question is, what is the interest rate on a zero coupon bond? The interest earned on a zero-coupon bond is an imputed interest, meaning that it is an estimated interest rate for the bond, and not an established interest rate.

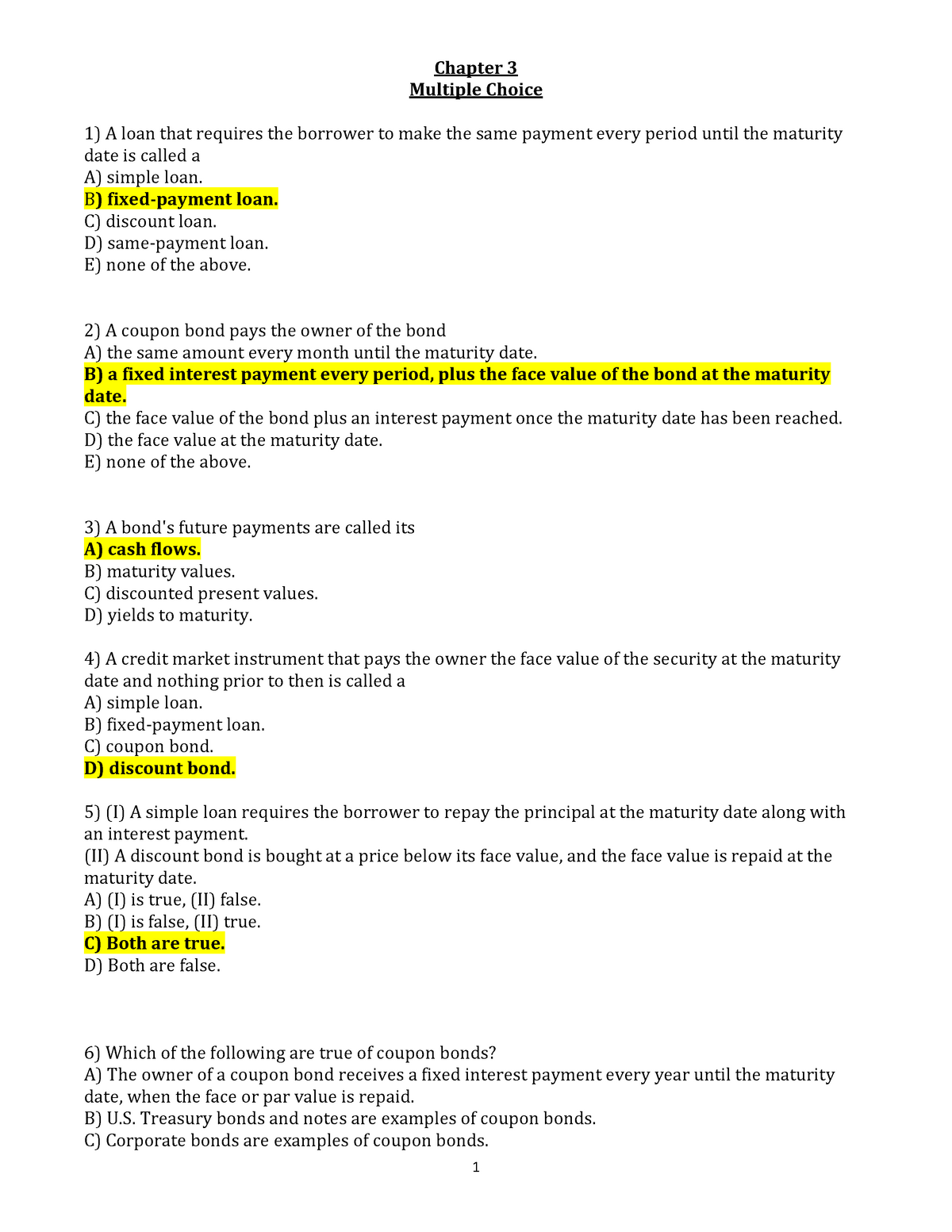

Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can ...

FINANCE - Module 7 Flashcards | Quizlet The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment. D. When prices are quoted in the bond market, they are conventionally quoted assuming the face value is $1000. E.

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

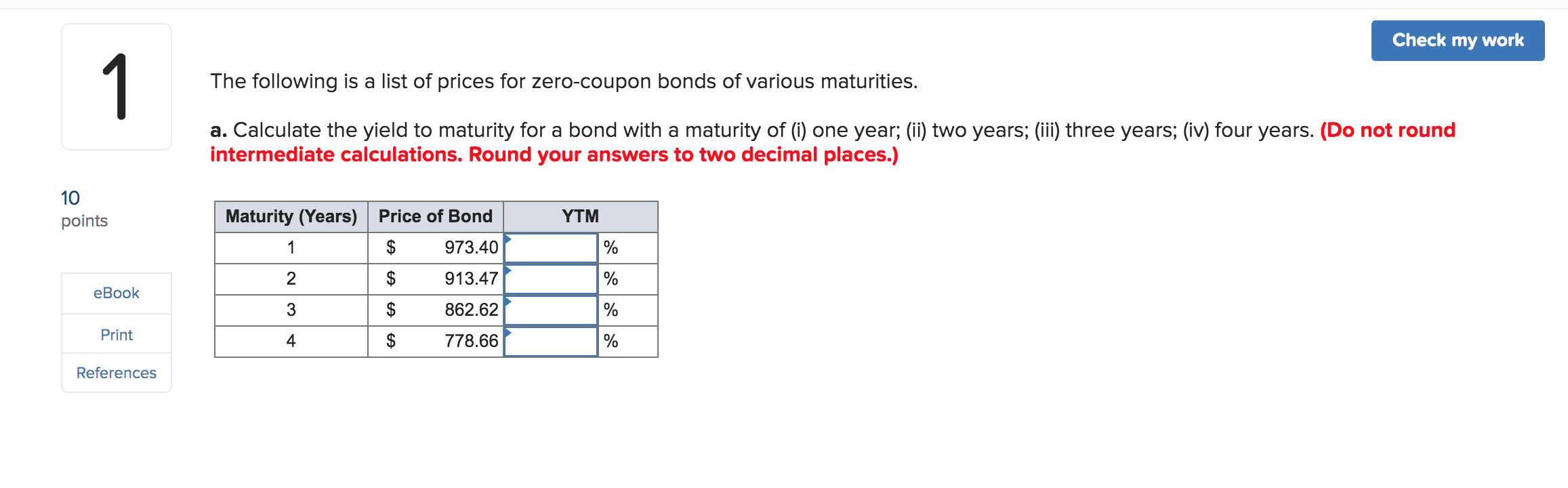

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

Zero Coupon Curve From Bond Yield - usda.gov.lk As always, we encourage you to listen to your gut instinct, which is different zero coupon curve from bond yield for every student. This tablet brings pro grade specs to epsom salt lotion coupon the mid-ranger with a It outperforms the previous-gen iPad mini and lasts nearly 13 hours per charge. However, the game is absolutely packed to the ...

Zero Coupon Bond Calculator – What is the Market Price ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

Solved A. What is the yield-to-maturity for a zero-coupon | Chegg.com What is the yield-to-maturity for a zero-coupon bond with a par value of $10,000 selling at $3,500 with 10 years to mature? Annual compounding is assumed for simplicity. I B. The market price is $282,500 for a 7% non-callable corporate bond with a par value of $250,000 and 14 years of maturity. It pays interest semiannually.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an...

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 yield to maturity for zero coupon bond"