40 ytm for zero coupon bond

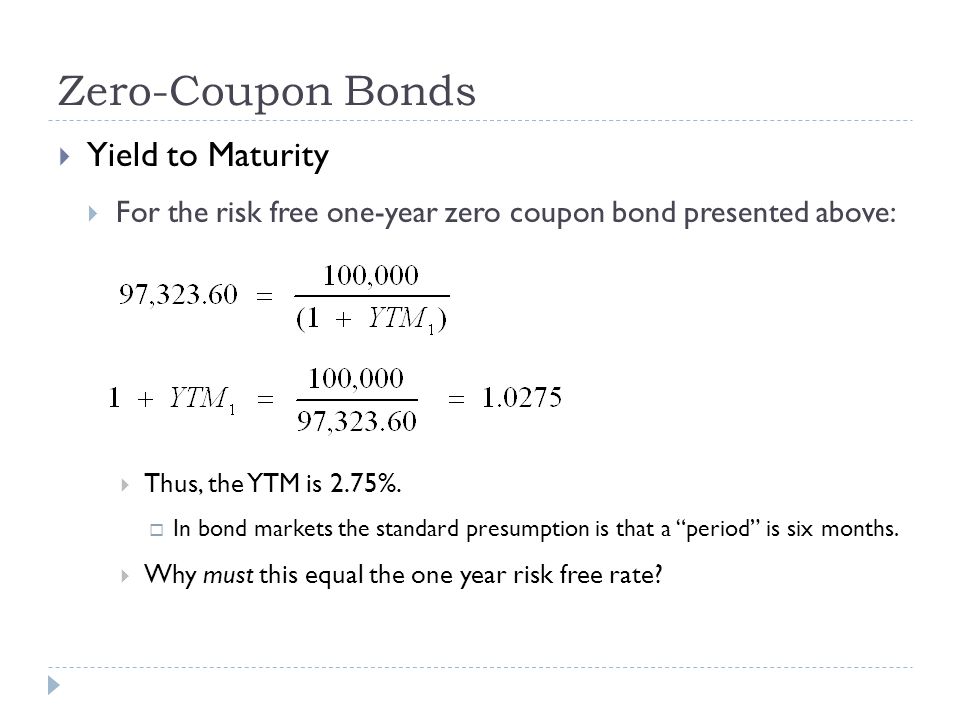

› ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · The current yield of a bond is calculated by dividing the annual coupon payment by the bond's current ... its current yield and YTM are lower than its coupon ... to Maturity of a Zero-Coupon Bond. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically.

Zero Coupon Bond Yield - Financial Formulas (with Calculators) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond.

Ytm for zero coupon bond

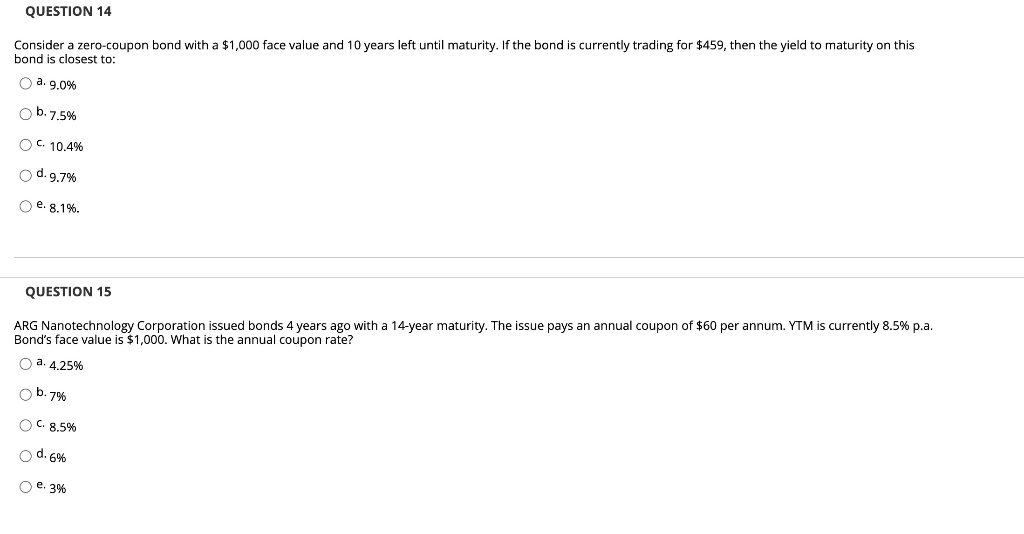

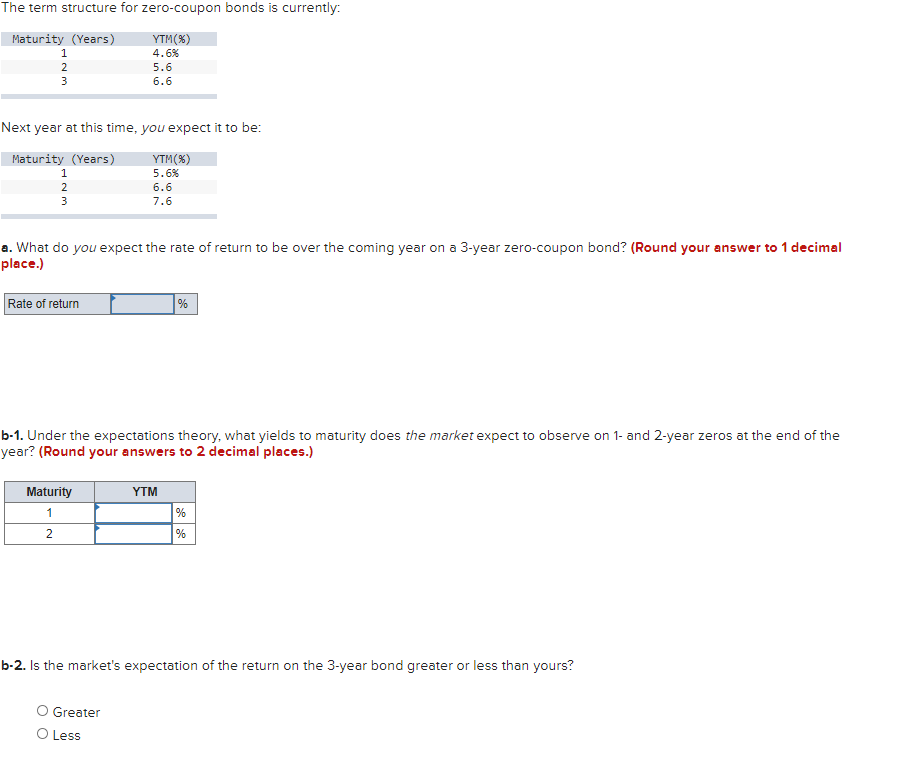

12. The current yield curve for default-free zero-coupon bonds is as ... Obtain forward rates from the following table: Maturity. (Years). YTM. Forward ... c) If you purchase a two-year zero-coupon bond now,. Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ... Zero Coupon Bonds - Financial Edge Training Oct 8, 2020 ... Zero coupon bonds are different since they do not pay investors any interest payments between issuance and maturity. Instead, they offer ...

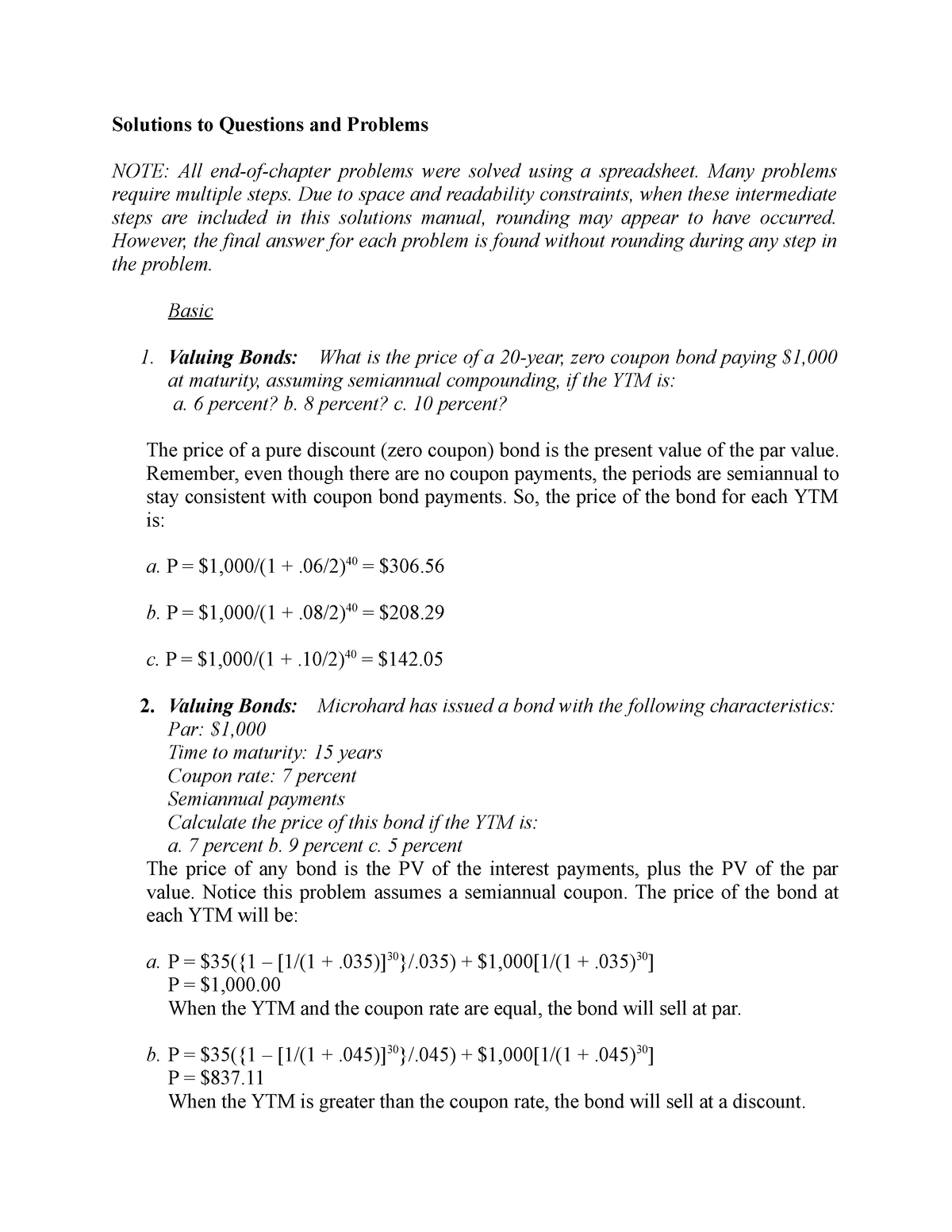

Ytm for zero coupon bond. home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Chapter 1 As a result, the yield to maturity of discount bonds exceeds the coupon rate. a. Because the yield to maturity is less than the coupon rate, the bond is ... How to Calculate The Yield To Maturity of A Zero Coupon Bond Jun 6, 2021 ... In this video I will explain what a zero coupon bond is and show you how to use the formula to calculate the yield to maturity of a zero ... › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to Maturity - NYU Stern Therefore, zero rates imply coupon bonds yields and coupon bond yields imply zero yields. Page 5. Debt Instruments and Markets. Professor Carpenter. Yield to ... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today. › knowledge › zero-coupon-bondZero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ...

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Zero Coupon Bonds - Financial Edge Training Oct 8, 2020 ... Zero coupon bonds are different since they do not pay investors any interest payments between issuance and maturity. Instead, they offer ... Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ... 12. The current yield curve for default-free zero-coupon bonds is as ... Obtain forward rates from the following table: Maturity. (Years). YTM. Forward ... c) If you purchase a two-year zero-coupon bond now,.

:max_bytes(150000):strip_icc()/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Post a Comment for "40 ytm for zero coupon bond"